Blog

Recent Posts

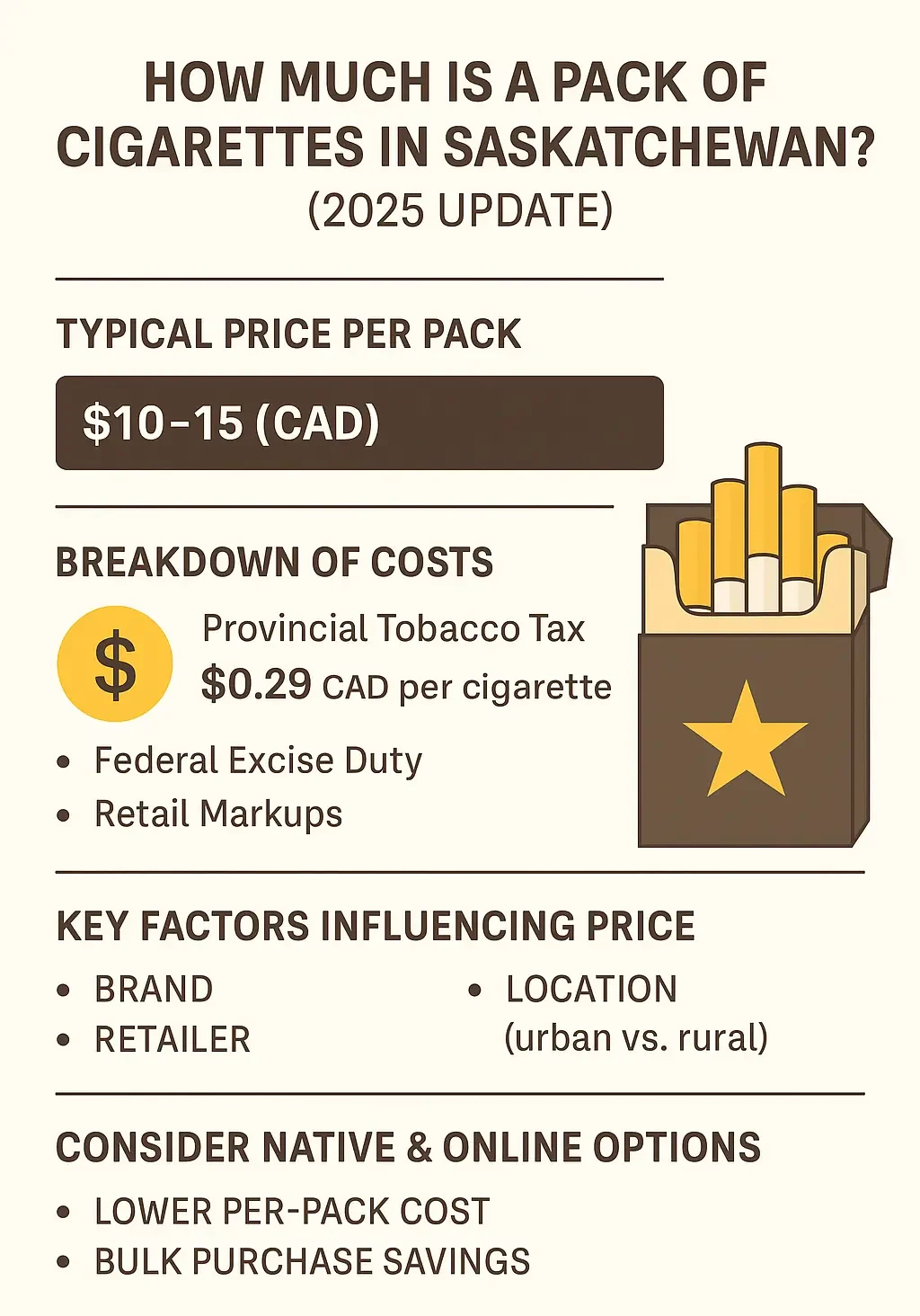

How Much Is a Pack of Cigarettes in Saskatchewan?

In Saskatchewan, a pack of cigarettes in 2025 typically costs CAD $10–$15, depending on brand and retailer. The provincial tobacco tax is CAD $0.29 per stick, which adds about CAD $5.80 on a 20-cigarette pack. Federal excise duty and retail markups further influence the final price. For smokers looking for value, buying Native cigarettes Online — especially in bulk — can often yield lower per-pack cost compared to in-store retail.

Saskatchewan Cigarette Prices : Average Cost Per Pack

If you’re curious about how much a pack of cigarettes costs in Saskatchewan, you’re not alone. Prices vary across Canada based on provincial tax rates, federal excise duty, and retail mark-ups. For 2025, Saskatchewan tends to fall in the mid-to-upper range among Canadian provinces.

Typical Cigarette Prices in Saskatchewan

- According to a recent survey, many packs of cigarettes in Saskatchewan fall in the ballpark of CAD $10–$15 per pack depending on brand, store, and region.

- For higher-end or premium brands, prices may be on the higher end of that range or even slightly above.

Because of variability (brand, store, city vs rural), this range gives a realistic snapshot for smokers in Saskatchewan.

Why Cigarette Prices Vary by Brand and Location?

Provincial Tobacco Tax in Saskatchewan

- As of the latest regulation, the tobacco tax in Saskatchewan is CAD $0.29 per cigarette stick.

- That means for a 20-cigarette pack, just the provincial tax portion is around CAD $5.80 before federal duty and retail markup.

Federal Excise Duty & Nationwide Levies

- On top of provincial tax, cigarettes are also subject to a federal excise duty (applied uniformly across Canada). According to 2025 rates, this excise duty adds to the overall cost per pack.

Brand, Retail Markup & Overheads

- Prices vary depending on brand—economy vs premium—retail mark-up, and supply-demand factors. Smokes sold in convenience stores, small towns, or remote areas may have slightly higher prices.

- Specialty or premium brands tend to cost more than economy ones, which explains the upper end of the price range in Saskatchewan (~CAD $15+).

What This Means for Cigarettes Buyers — Including Native & Online Options?

For smokers looking for affordability, especially those interested in Native cigarettes online near you, Saskatchewan’s pricing landscape reveals a few opportunities:

- Given moderate taxes and competitive pricing, buying by the pack may remain relatively affordable compared to the highest-tax provinces.

- Online retailers or Native-brand suppliers may offer bulk deals or carton pricing that provide savings per pack, especially for regular smokers.

- For budget-conscious buyers, choosing economy brands or buying in bulk (cartons) can significantly reduce per-pack cost.

FAQ: Cigarette Prices in Saskatchewan

Q1: Why does the per-pack price range from $10–$15 — such a broad spread?

A: Because different brands, store locations (urban vs rural), and retailer mark-ups create variation. Economy brands tend to lower cost; premium ones raise it.

Q2: How much of the price is tax vs actual tobacco cost?

A: Saskatchewan’s provincial tax is 29¢ per cigarette — ~$5.80 for a 20-pack. On top of that comes the federal excise duty plus retail markup and other overheads.

Q3: Are online or Native-brand cigarettes cheaper than in-store in Saskatchewan?

A: Often yes — bulk deals, cartons, and lower overheads can result in lower per-pack costs when buying from reputable online retailers that comply with age verification.

Q4: Does price vary between cities or rural areas in Saskatchewan?

A: Yes — remote areas or small towns may have higher retail markups, causing slightly higher prices. Cities and well-stocked stores tend to offer better rates.

Q5: Is it legal to buy cigarettes online if shipped to Saskatchewan?

A: Yes — as long as the retailer follows legal age verification (proof of age) and complies with federal/provincial tobacco laws.

References:

- Saskatchewan Tobacco Tax Rate – Official: Overview of per-stick tax rate (29¢) for cigarettes in Saskatchewan.

https://www.saskatchewan.ca/business/taxes-licensing-and-reporting/provincial-taxes-policies-and-bulletins/tobacco-tax (Government of Saskatchewan) - Federal Excise Duty on Cigarettes (2025 Rates): Updated excise duty for cigarettes across Canada, effective April 1, 2025.

https://www.canada.ca/en/revenue-agency/services/tax/technical-information/excise-duty/excise-duty-notices/edn101-adjusted-rates-excise-duty-tobacco-products-effective-april-1-2025.html (canada.ca) - Saskatchewan Cigarette Price Survey (2024–2025): Report showing typical retail price range (CAD $10–$15 per pack).

https://smokescanada.com/how-much-is-a-pack-of-cigarettes-in-saskatchewan/ (Smoke Canada) - National Overview: Cigarette Prices Across Canada 2025: Comparative data showing how Saskatchewan fits in national pricing.

https://smokescanada.com/cigarette-taxes-in-canada-2025-how-they-vary-by-province-and-what-it-means-for-you/ (Smoke Canada) - Historical Price Data & Smoking Trends in Saskatchewan: Data including past average pack price and consumption patterns.

https://uwaterloo.ca/tobacco-use-canada/adult-tobacco-use/smoking-provinces/saskatchewan (University of Waterloo)